The native token of Dolomite, $DOLO, which has officially been launched and is already making significant splash. After two years of operating quietly in the background, the project has finally gone live today and started debuting on decentralized and centralized exchanges. But after a highly explosive start, its price action is flagging red signals that most experienced DeFi traders are familiar with.

Dolomite: Hype-Fueled Start Followed by a Steep Drop

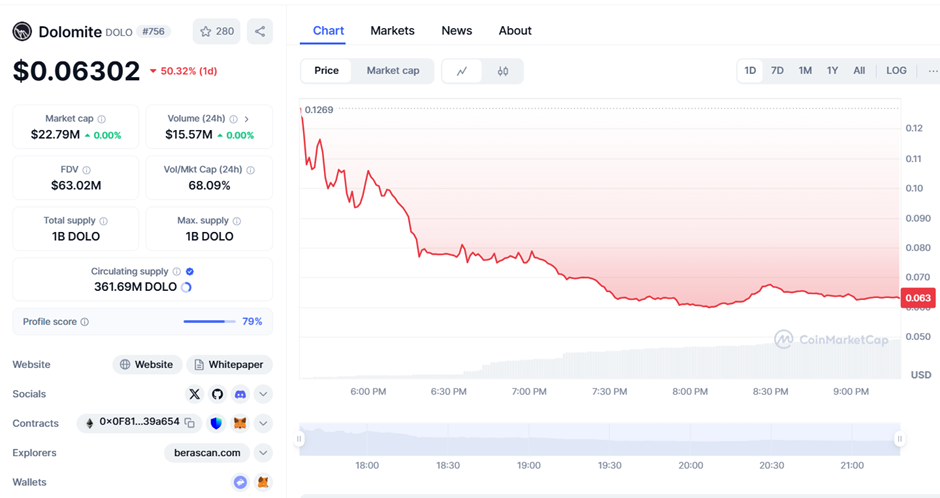

At 8:00 AM EST, $DOLO started trading on Uniswap and KodiakFi, followed by a listing for centralized exchanges on KuCoin, Bitget, and Bybit at 1:00 PM UTC. The token blasted off at $0.1269 and tagged its first ATH before occupants were on to the next event.

Now it has plummeted over 50% within hours and touched a low of about $0.05979 before rising a little to $0.063. The initial trading volume reached $15.58 million, which now seems to be vanishing as the excitement dies down.

Dolomite Technical Analysis: Classic Pump and Dump or Early Growing Pains?

As per this pricing movement, it replicates a textbook pattern of a so-called “pump-and-dump“: intense interest in the initial stages followed by a rapid catching of profits followed by a swift jettisoning of the asset. Key support is forming around $0.059 while resistance is from around $0.070.

If DOLO breaks the support at $0.059, then the price could descend closer to such psychological levels as $0.050. However, probability has it that the price will instead consolidate between the levels of $0.058 and $0.070 with declining volume.

Market Sentiment and Short-Term Forecast

At above $1 billion in Total Value Locked (TVL) and close to a billion in historical trading volume, Dolomite is still subjected to some price action, but it means that fundamental interest in the project remains high.

Yet, the token will not be able to reverse the bearish momentum in the short run without a new catalyst. Therefore, market observers should watch out for:

– Spiked volumes or new exchange listings

– Strategic partnerships or protocol updates

– Strong ROI of Berachain or Ethereum layer-2 involvement

Failing any of the above occurring soon, chances are bearish sentiment could reign for the next 24 to 48 hours.

Short Term Bearish but Long-Term Uncertain

There was hype on launch for Dolomite, but the lag is much worse. DOLO would tend to stay confined towards the bottom end of its launch range in the near term, while volatility would likely continue as the market digests real value of the token.

Source: CoinMarketCap

2 Responses